When Apple launched the Apple Card, it came without any way to export your transactions such that you could import the data into a personal finance app—all you could get out was a PDF. Apple started to rectify that glaring lapse at the beginning of the year by adding the capability to export transaction data in CSV (Comma Separated Values) format (see “Apple Card (Finally) Gains CSV Statement Export,” 23 January 2020).

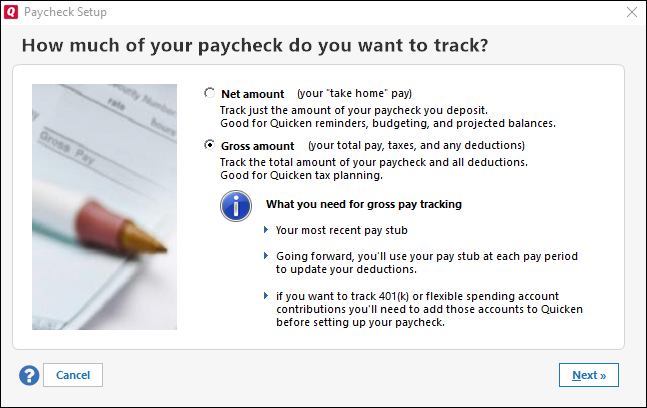

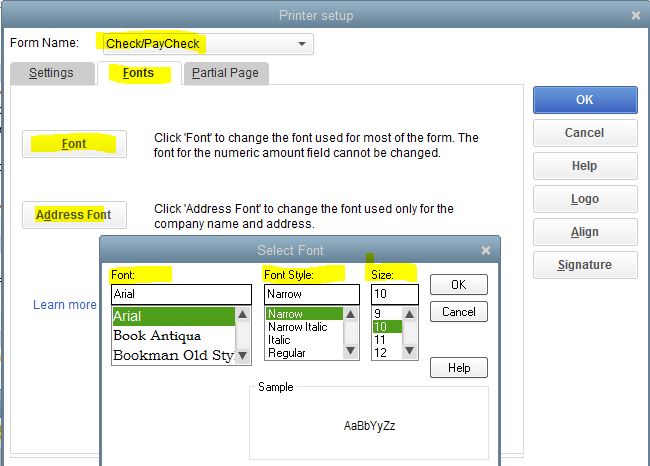

Quicken offers tiered pricing options based on the features you use, as well as the product you choose. Quicken, like many other personal finance software applications, has shifted to a subscription model. You pay every year. Quicken for PC: Minimum = $34.99, Maximum = $99.99; Quicken for Mac: Minimum = $34.99, Maximum = $74.99. I'd like to track on on Pay Check setup on Quicken what employer pays for. There is an option to add pre-tax deductions, but those are my portions that I have to pay. Quicken is the most powerful money management software on the market. Learn more.For more Tips and Tricks, visit:https://www.quicken. Pay From Account: By default, Quicken will use the account that you enabled for Check Pay. If you have more than one account, you can choose another Check Pay enabled account. You can optionally enter information for the Category, Tag, and Memo fields. Adding this information will improve Quicken reports about your payments and transactions. I didn't see a topic or community set up for Apple Card yet so I'm starting this thread on Apple Pay, somewhat related, just to get the discussion rolling. I recently accepted the Apple Card invitation and contacted Help/Goldman Sachs to see if they support Direct Connect functionality in Intuit’s Quicken for Mac financial management software.

However, CSV format wasn’t sufficient for many personal finance apps. In February 2020, Apple added support for OFX (Open Financial Exchange) format. It was a somewhat troubled release, with TidBITS Talk participants trading tips on how to edit exported files to get them to import properly into various apps. Apple worked out the kinks over the next few months, and the complaints died down.

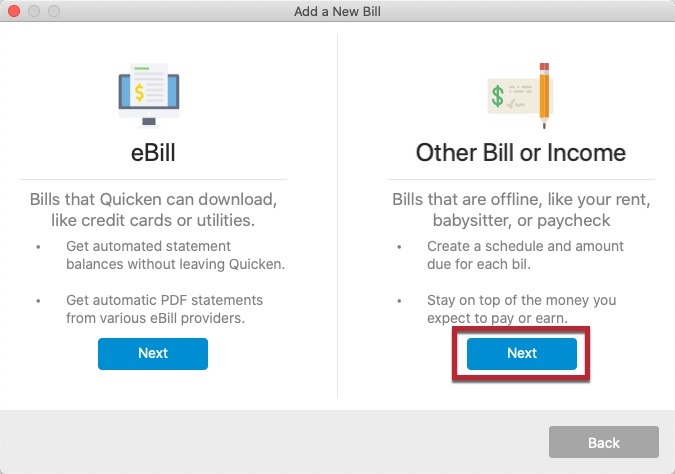

Now Apple has extended the formats available to Apple Card users even further by adding support for Quicken’s proprietary QFX (Quicken Financial Exchange) format, which is an extension of OFX, and the QBO format used by Intuit’s QuickBooks. Here’s how you export those formats:

- Open the Wallet app on your iPhone.

- Tap your card balance.

- Under Statements, tap the desired month.

- Tap Export Transactions.

- Choose either Quicken Financial Exchange or QuickBooks. Comma Separated Values and Open Financial Exchange are still options.

- Choose the destination from the share sheet. The easiest ways to get them to your Mac are probably AirDrop (your Mac might be an AirDrop shortcut at the top of the share sheet), which will send the exported file to your `~/Downloads` folder, or Save to Files (pick a location in iCloud Drive).

For something that’s human-readable, you can still download your statement as a PDF. In Step 4 above, instead of tapping Export Transactions, tap Download PDF Statement.

How To Input Pay Stub In Quicken For Mac 2020

Here’s how you can use the various formats Apple Card can now export:

- QFX: Import into Quicken by choosing File > Import > Bank or Brokerage File.

- QBO: In QuickBooks, choose File > Utilities > Import and then Web Connect Files.

- OFX: Import into any app that supports this format, like Banktivity, Moneydance, and You Need a Budget.

- CSV: Open in any spreadsheet or import into an app that supports CSV import and lets you map import fields appropriately.

- PDF: File for later reference or print; it’s not structured data that you can import.

If anyone has figured out how to automate this process with Shortcuts, let us know!

How To Input Pay Stub In Quicken For Mac Download

Now if only Apple would let multiple people in a family share an Apple Card. Other common requests include the capability to download transaction data without waiting for a statement and support for other countries. How else would you like to see Apple improve the Apple Card experience?